You’re ready to send your idea to your development team and start building a real product. Your dream, flash of inspiration, or application of business wisdom is about to become a real thing, with invoices, phone calls and customers.

Before you do that, you should make sure you and your idea are ready. Have you made sure your new business has the best possible chance of success? If you haven’t asked yourself these five (OK, six) questions, you should.

1: Has the core benefit been validated?

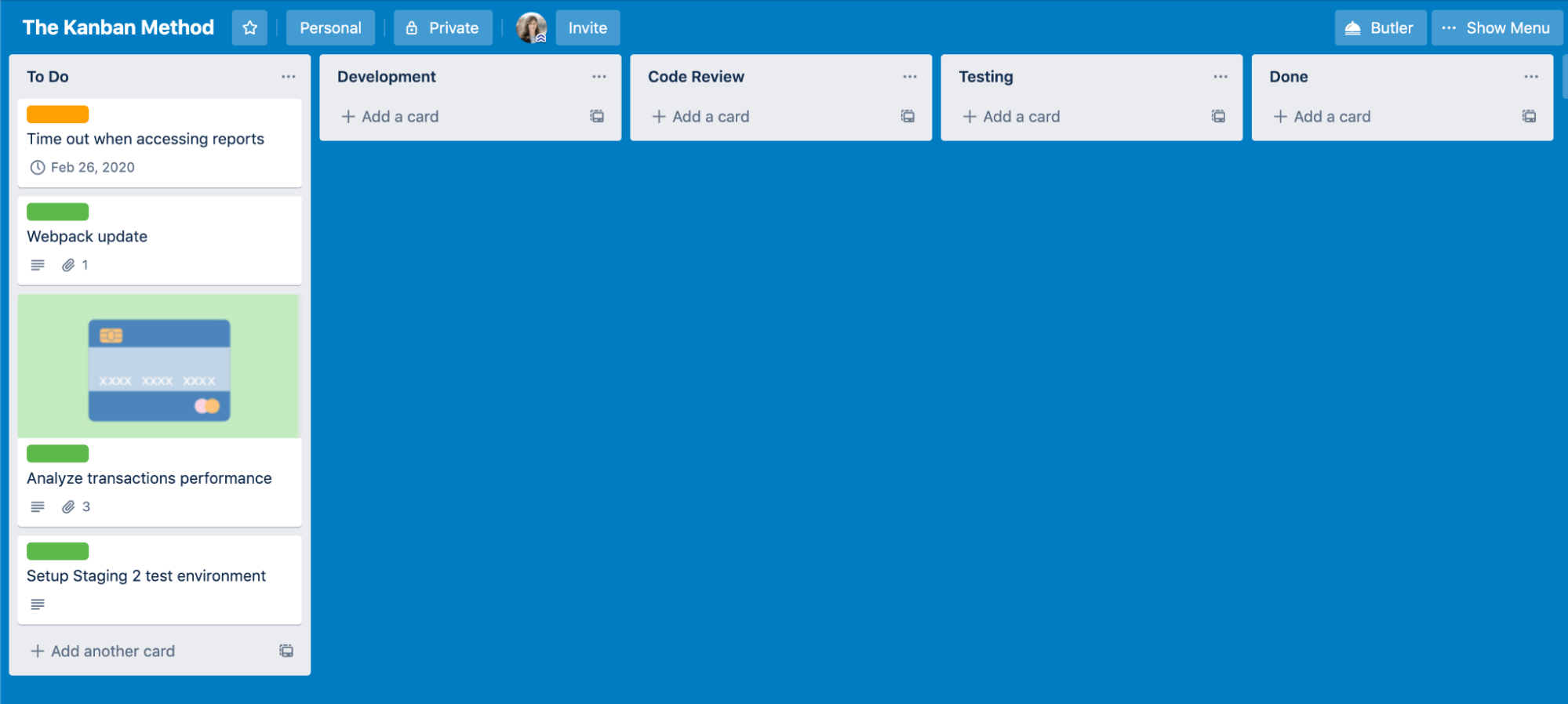

In other words, do people actually want something that solves the problem you solve? For example, let’s think of Trello.

You can do a ton of different things in Trello, especially if you’re happy to use the ever-growing range of power-ups. But the core benefit is that you can organize stuff simply with a Kanban board.

It doesn’t really matter what kind of stuff it is — in a way, that’s the point. But does anyone want to do that?

If they don’t, there’s not a lot of point to building out a bigger suite of services and products, power-ups, APIs… that’s like adding power steering to a car no one wants to drive.

The conventional wisdom is that what we’re talking about here is validating the problem. Have you correctly identified that there is a problem out there, causing appreciable distress or difficulty to individuals or organizations, that your product or service can solve? One way to find out is to hang out on the forums where your target audience goes, and see what they say. Another is to get some test users and ask them.

Sometimes when you do this, you realize that your core benefit isn’t what you thought it was! Flickr was envisaged as a chatroom for an online role-playing game, with real-time image sharing. Soon the company realized what their real product was, but not before the concept of an online asynchronous messaging tool had inspired a podcaster called Jack Dorsey. Yes, that Jack Dorsey.

It’s not always true that a new business or product idea removes a rock from people’s shoe. Sometimes, a new product or service actually creates a whole new category of offering — it creates new opportunities rather than solving existing problems. No one in 2006 was complaining that their flip phone wasn’t an iPhone. If this is you, you could be on to one of the greatest business advantages possible. But you still need to have an idea as to whether it’s actually desired. So you still need to be looking at customer feedback, getting meetings with prospects and interviewing, surveying, and watching early users.

This often means creating marketing assets before you have a product. Consider creating a landing page that tells visitors what’s going to drop, and when. The ask for this page is a signup so you can email them when the product’s ready. As long as you don’t do it too often, you can email them with updates and requests for feedback too. This is most effective when you combine it with some paid traffic acquisition to get larger sample sizes.

2: Has the core feature set been validated?

Let’s assume that you’ve ascertained there’s a real market for the benefit your product offers. Do the features you’re planning to build deliver the benefit you’re aiming for? Think of Trello again. The core benefit is the ability to organize things with Kanban boards. The core feature set is boards, cards, lanes, and checklists and text on the backs of cards. Everything else that exists in Trello is built on or around these features, and if you take even one away, you’re left with a non-functioning version of Trello. So, do your target customers want these features in a Kanban organizational tool? Would they prefer some other features? Would they find a list or timeline layout more intuitive and functional?

This is the time to figure out the same about your customers. If your benefit is innovative but your features aren’t you might be able to road-test your idea, letting test users try different delivery methods. If your product is entirely new, congratulations on a rarity — and caution is advised. You’ll have some difficulty with users who may be unfamiliar with features or interface elements, but this is good practice for marketing those features later. You can use no-code platforms like Bubble or Glide to create mock-ups that you can then get customer feedback on.

Whichever situation you’re in, this stage is mostly about checking that the features you’re planning to build into your product are the best ones to deliver the core benefit(s) — in other words, that your product makes sense in terms of your business. The people whose opinions matter about this are your customers’, a strong argument in favor of doing as much user testing and interviewing as possible, as early as possible.

3: Has the market been validated?

Assuming that core benefits and features are validated, is the market to support your business launch and growth there? Are there customers waiting? Is the size of the opportunity worth the expense and effort of development?

Ideally, you’ll have numbers to support this. Yes, we know of businesses that launched when they had no real knowledge in this area, just insight, but the Microsofts and Apples of the world are very much the exceptions.

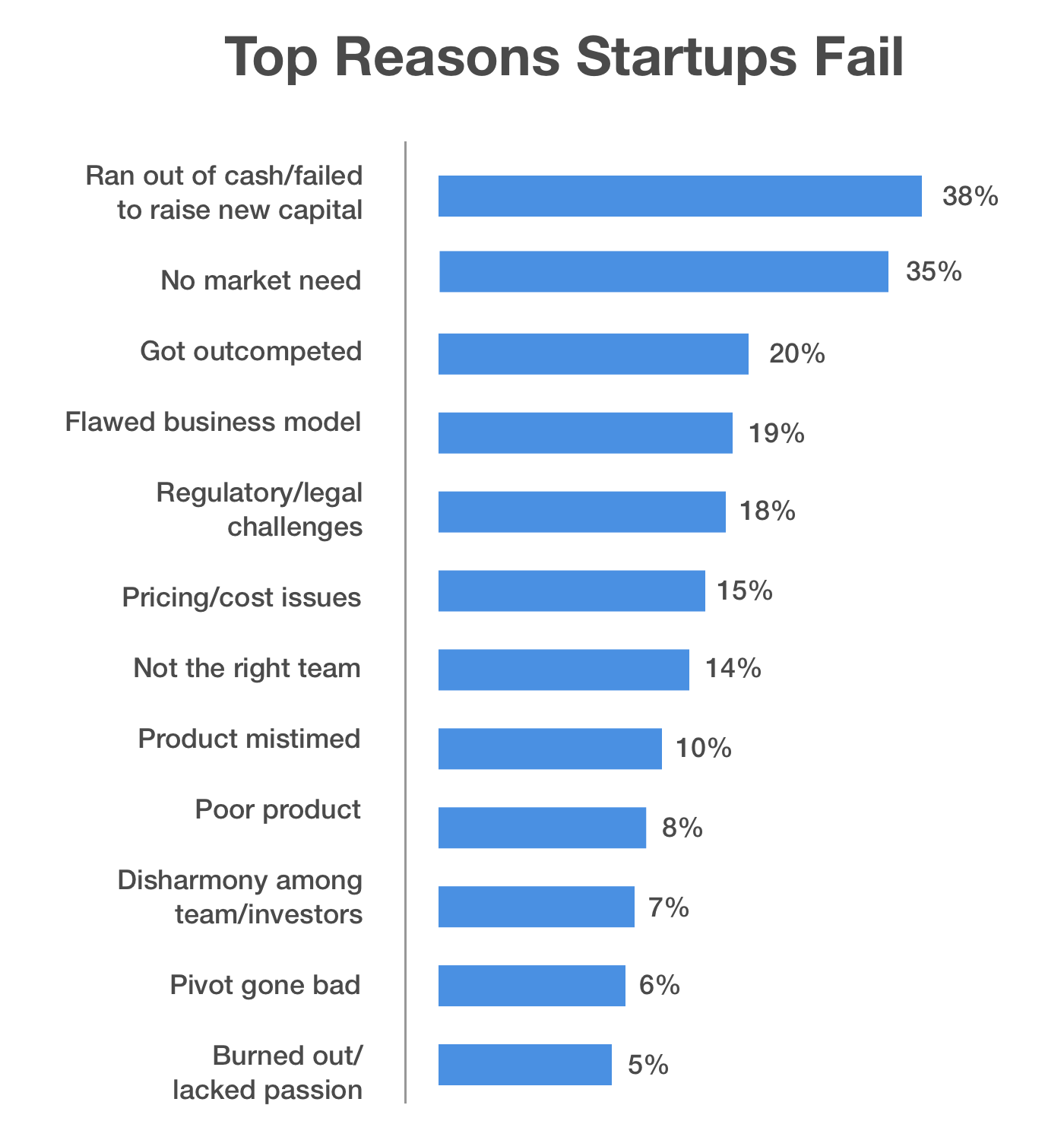

Most startups fail because they can’t make the transition through the first year: they can’t get a product to market quickly enough and when they do, they can’t hold on to customers. 38% can’t raise capital or run out of money; 35% have no market need; 20% get outcompeted.

They’re validating their market while launching, instead of before.

Some of this can be done online, inexpensively and relatively fast. For example, you can search for a specific problem that matches the one you solve, or a specific solution that matches the one you provide. ‘I can’t find a X’ or ‘why doesn’t anyone offer ‘Y’ or ‘how do you…’ You can then use Google Keyword Planner or similar tools to identify search volume and competitiveness. Both numbers matter: very low volume but high competition suggests a small but remunerative market; very high volume suggests a large market, but are they willing to pay?

Dig around on forums for posts like this. Or identify tools that almost match the functionality you offer and search for ‘how do you do [core benefit as an action] in [competitor]?’ We’ve been using Trello as an example, so imagine searching for ‘how do I use Kanban in Basecamp?’ Bear in mind, Trello launched in 2011. Everyone has Kanban now, but back then, project management tools were much more unwieldy.

You should end up with some idea of your Total Potential Market: everyone who might possibly be interested in a product like yours. But you’re not going to capture the whole market. You’ll be constrained by all sorts of limitations, including your ability to service enterprise clients who often require custom contracts and coding, your range of APIs, and your ability to market and outcompete others in the space.

So you need to tighten down your potential market to your TAM: Total Addressable Market. You can think of these as the customers you haven’t won yet. Are there enough of them, sufficiently willing to pay for a service like yours?

All these should be achieved by your MVP — sometimes before the stage where you build any functionality at all.

4: Are there similar solutions in the market already?

Some new products are entirely novel, creating their own category in the way that the iPhone created the smartphone category. Others revolutionize or disrupt a sector. But many offer incremental improvements. Think of it like the difference between a whole new type of operating system, like when MS-DOS came out, and an incremental update, like a new version of Mac OS today.

Solutions can be similar to yours in two key ways: they either do the same thing, or they appeal to the same people. For example, Trello competes with other Kanban tools (does the same thing) and with other project management tools (used by the same people).

Scoping out the competition like this gives you three benefits. You can see how much of the potential market is accounted for, check up on best practices in your space, and figure out what you’ll do differently or better to stand out.

For example, in the martech space, things are crowded. There were 8,000 tools out there last year, up from 7,000 in 2019. Getting into martech is like getting on a commuter train in Tokyo. But agricultural administration technology is (appropriately) a wide open space: if you can come up with something that can beat Excel, there’s a ~ 160 billion dollar industry out there that can’t wait to meet you. It’s not just a large market: it’s an unserved one.

Best practice is a massive time saver. You can use a range of common SEO and analytics tools to see what has worked for others in the same space. Pay particular attention to pairs of businesses that are similar except that one failed, one succeeded.

You can use Google to find a business that’s still around and going strong, then SEMRush to identify the top organic keywords for that business’ website. Search Archive.org for those terms, or use an advanced Google search with the time parameters set to Custom>[ends a year to two years ago]’ to see collections of companies that emerged alongside them. Then you can find out what happened to those companies. Remember that the ones that vanish didn’t all fail — some will have been acquired by bigger players.

Now, check out what your successful companies did differently compared to the unsuccessful ones. Use SEMRush and Ahrefs to see their marketing strategies. Ask around on LinkedIn and your network to see what people remember, because those impressions made their contribution to each business’ success or failure. And read around their mentions to see what their internal culture, planning and financials were like. It might even be worth approaching a firmographics agency to get as much information as you can. Do this a few times, and then copy the successful ones and don’t do what the failed ones did.

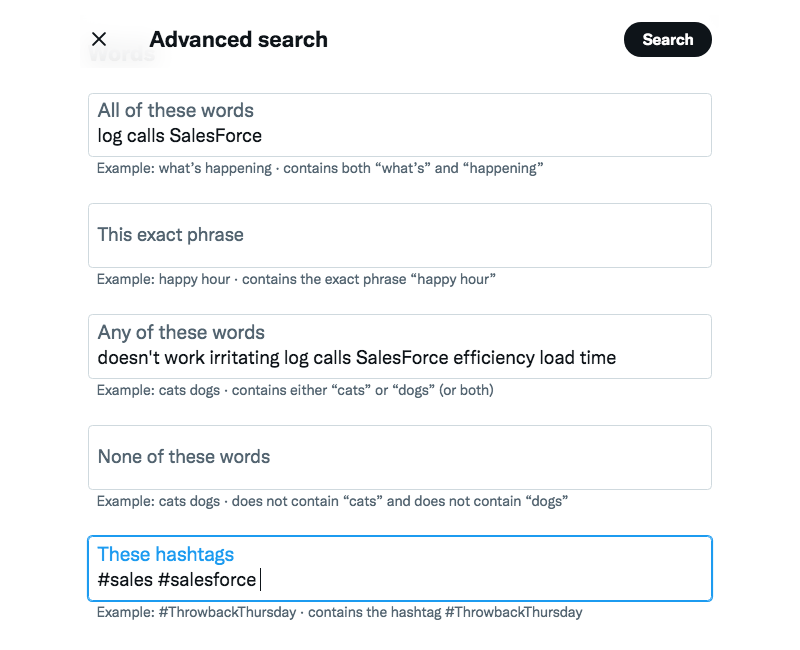

It’s also worth looking for what people conspicuously hate about their current tools. Just because the market is accounted for, doesn’t mean you can’t compete for and win it on the basis of features, UX, support or some other element. Check out Twitter Advanced Search, and search for hashtags that would be relevant, words like ‘hate’ or ‘not work,’ and names of competitors.

Twitter is a key customer complaint channel, so check out tweets that were @ the company accounts of your rivals.

You can do the same thing on Reddit too. If you’d like to see ways that you might be able to outcompete SalesForce on its own turf, for instance, try searching Reddit’s r/sales subreddit for ‘SalesForce’ and you’ll see plenty of potential answers.

5: How scalable is it?

Can your product be scaled in the future, and how? These questions bear on both business and development decisions. You also need to look beyond the best-case scenario. Imagine you get all the customers you want, and growth beyond your wildest expectations. It does happen; growth is unpredictable. Can you keep pace? Suppose your business was ten times the size it is now in a year’s time. How will you hire, train and deploy new staff? How will you build processes to handle support requests, onboarding, billing, from all those new customers? In their first couple of years, a lot of startups go from ‘we built this cool thing on our laptop’ to hiring for their first $100k+ per annum C suite role. Look around at how to do it and plan, because it comes at you fast.

It’s the same on the tech side of things. Managing things like dependencies can grind growth to a halt, as the tech requirements grow exponentially faster than the business. You can find yourself as a tech startup making big revenue and achieving impressive growth, and losing money at the same time as you hurry to patch the holes in your product.

At its most basic, the issue is whether your product, and your business, have been built to scale. The business end is a matter of research and mentoring. But building the products? That’s what we do. You should find a developer or team that builds for next year or the next five years, not for now. Use projected growth, with wide margins for error, to project future technical requirements and build a small product that can be expanded into a big one without someone having to write a whole new codebase while you celebrate your 100,000th customer.

Bonus question: would you use it?

Maybe you don’t need it, but would you use it if you did? This is a gut-reaction check as much as anything else. If something feels off, go round again, or talk with your developer and the rest of your team. It’s pretty crucial to your business’ success that you feel fully behind it.

Conclusion

Checking that your product has a market, and that the features you’re planning to build will actually appeal to that audience, is vital to your business’ success. If you do this, everything that happens for the next few years can be part of the plan. You’ve already seen it coming. But if you don’t it will be the wrong kind of moving fast — running to stay still while the crises multiply — and the main thing you break will be your business.